b2b insurance tool

Tangible interface based on visual thinking.

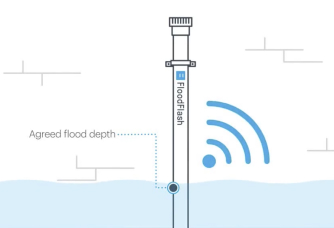

FoddfFlash is a tech-enabled flood insurance provider that uses internet-connect sensors to detect floods and payout predefined settlements.

“This parametric insurance policy and the way it works by using the sensor is completely new and requires time for customers to understand.”

Evaluation

The product relies on a smart sensor that measures the depth of the flood in the property and payout predefined settlements.

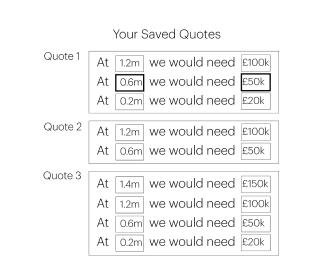

Floodflash hired me to design brokers' interface to configure quotes for end-users. The tool must allow set up more than one quote with individual payouts for each settlement based on diverse parameters.

Complex interaction

While business owners are end-users, the business operates with third-party brokers who set up those quotes based on data provided through the tool. Therefore is a B2C web tool with many touch points involved on the process.

Not the problem,

just a symptom.

I interviewed stakeholders and brokers to understand the business better and create quotes. The team had done admirable research on checking features and criteria for accurate quotes, so my job was to bring things together in an interface that reacts to variables so brokers can make changes on the fly based on customers' requirements.

However, I found that beyond setting the quote, the main hurdle for brokers was informing clients of the benefits of this new insurance, and the number of options further complicated the procedure.

Exploration

How to transition from a numerical model to a more educational data-driven approach?

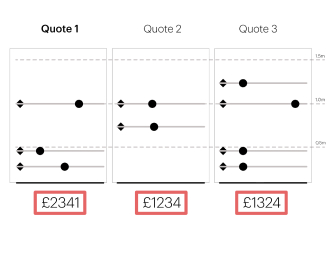

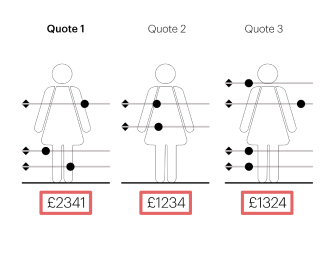

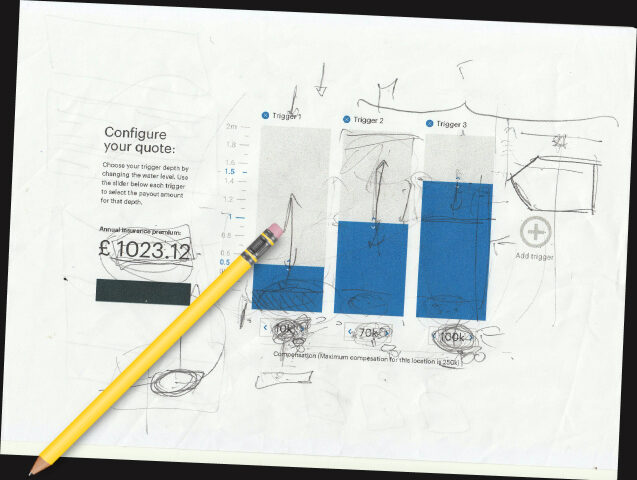

During my observations, I noticed that brokers often draw human shapes or doors to show depths associated with quotes and payments. To deepen this concept, we conducted a series of workshops to develop solutions that allow brokers to visually inform processes while setting up quotes.

First, we defined requirements to figure out the initial problem statement:

Design principles

Easy

to use and communicate

Fast

to set up and get results

Flexible

enough to allow changes on the go

Constrains

Responsive

adaptable to every screen

Expandable

grows as the client adds more quotes

Printable

as agreement proof

We transfer the best idea to a paper prototype to test with the brokers and let them be involved in the process by testing the concept with end-users.

Allow customers to design the cover from quote to claim, change the think about risk with quick payments based on the depth of the flood instead of the cost of the damage.

Progressive disclosure

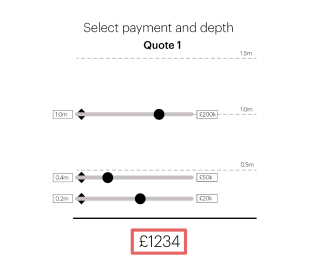

To increase clarity, we split the data padding into related groups, leaving the last step to interact with quotes so customers can better focus on what matters.

This option not only makes sense of data collection, but it also helps to distribute information among involved third parties at the right time.

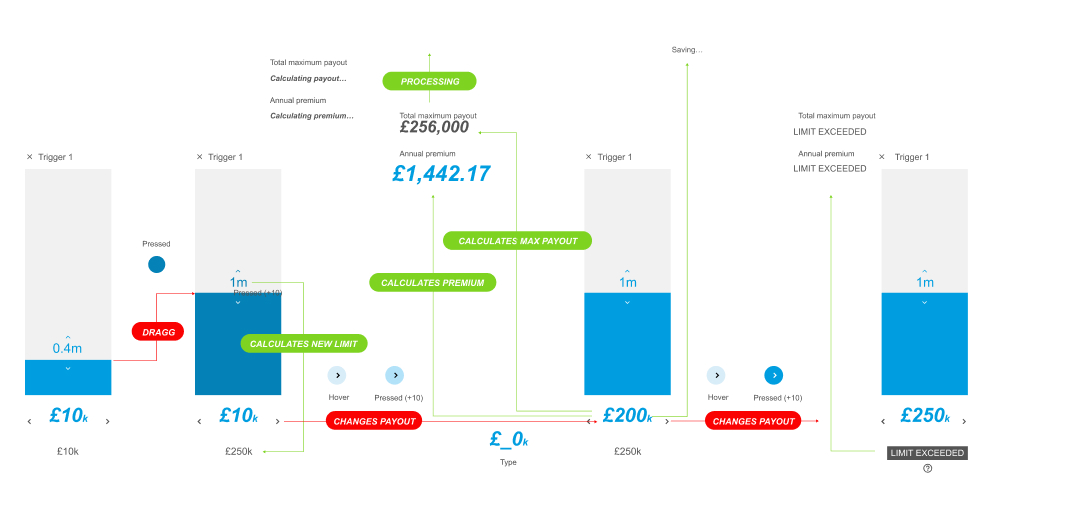

Execution

The result was a tangible interface with a visual representation of damages that allowed end-users to not only understand what the new policy was about but also to experiment and explore options that best fit their specific needs.

Since brokers use tablets for their door-to-door visits, they can set up quotes while communicating the new policy and provide fast, easy and flexible cover for the businesses.

Outcomes

Within the first month, the number of brokers who interacted with their clients using the interface exceeded the expectations for the quarter. Consequently, the conversion rate of clients that applied for a final quote reached 60% and increasing.

Brokers improved communication and reduced considerably the number of steps to get an accurate quote

“Now is so much easy to address our customers”

The configuration process changed from days to minutes

“ I have more time for details as my clients see results faster ”

The whole process is automated to give quotes in real-time.

“We can do changes and get the quote within seconds”

Nanodoce

the alter ego behind Fernando Magan.

©nanodoce 2024

Please note that most projects are subject to a confidentiality agreement.