Discovering value

The journey, not the destination.

The journey, not the destination.

“In order to be investors first, we must first develop a deep understanding of our target customer”

“In order to be investors first, we must first develop a deep understanding of our target customer”

This research set out to understand the range of investors who choose our client and those who may in the future. With this understanding, we can identify opportunities to offer a more valuable experience, both for the investors and for our clients.

We interviewed professional and private investors, their advisors, and colleagues. It was a qualitative study with a broad participant spectrum. The team followed up with design provocations and deeper questioning as part of further research to gain richer insights around areas of greatest potential value.

What we set out to understand

PRODUCT & SERVICE INTERACTIONS

Explore touchpoints, channels and information design to inform opportunity areas in future customer journeys.

HIGH-LEVEL OUTCOMES & VALUE

Find new opportunities for value through a deeper understanding of motivations, behaviours and goals.

KEY INFLUENCERS & INTERACTIONS

Understand the roles involved, their level of influence, and their interactions.

AMBINITION FIT

What's the investor progress and our clien t mission.

What we did

IMMERSION

Met with colleagues from our client understand wealth, institutional landscape, market sizes, and jobs to be done.

HYPOTHESES DEVELOPMENT

Find new opportunities for value through deeper key stakeholders through collaborative workshops. Designed research programme and began planning for field research.

FIELD RESEARCH

Visited key markets (CH, DE, UK, USA) to interview participants from a range of roles and organisations, as well as individual investors in UK, DE and USA.

45 Interviews were completed.

MAKE, TEST & LEARN

What's the investor progress and our client mission based on findings so far: develop richer stimulus to help further explore selected themes and user needs. Rapid prototyping and iteration of product and proposition ideas.

Depth interviews carried out remotely in the US and EMEA.

Hypotheses

How the hypotheses map to the purchase tunnel. This model was chosen as a baseline as it underpins some previous research outputs. But many of our participants suggested that their journey is more cyclical than this.

INVESTMENT DECISIONS ARE DRIVEN BY GOALS

RESEARCH FOLLOWS A FREQUENCY

PEOPLE USE A VARIOUS SOURCES FOR RESEARCH

PERSONALIZABLE TOOLS ARE MORE VALUABLE

"OFF THE SHELF" INFORMATION IS VALUABLE IN A PURCHASE JOURNEY

VALUE FOR MONEY IS THE MAIN REASON FOR ADOPTING ETFs

BRANDS PLAY A SIGNIFICANT ROLE IN DECISION-MAKING

INVESTORS CHOOSE WELL-KNOW ETFs AS A GATEWAY INTO PASSIVE INVESTING

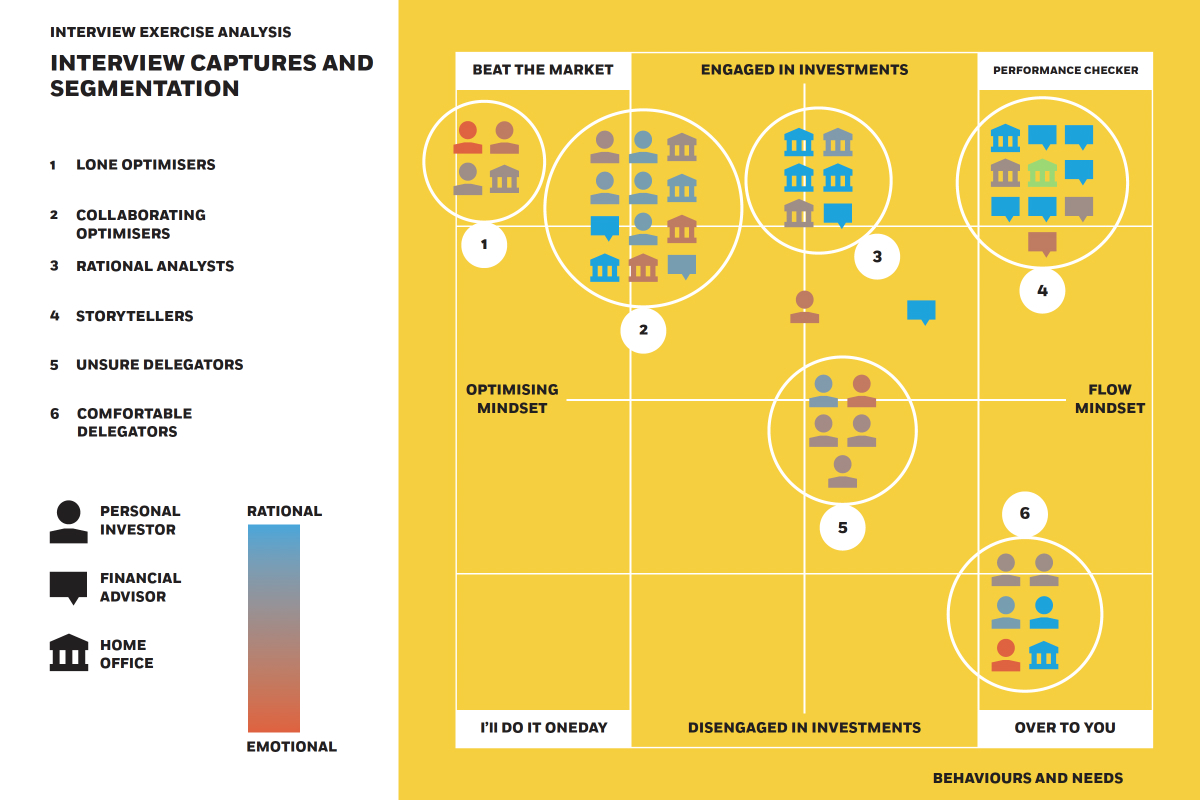

Interview captures

How might we use what we have learned to become "investors first" and create new value for our clients? The goal was to set a clear direction for the client's digital activity.

1. SEGMENTATION

Goals / motivations

Pain points / frustrations

Which persona is like this

Role for our client

Top content sources

2. THEMATIC ANALYSIS

We identified nine patterns by looking at our list that involved active interpretation of the codes and the data.

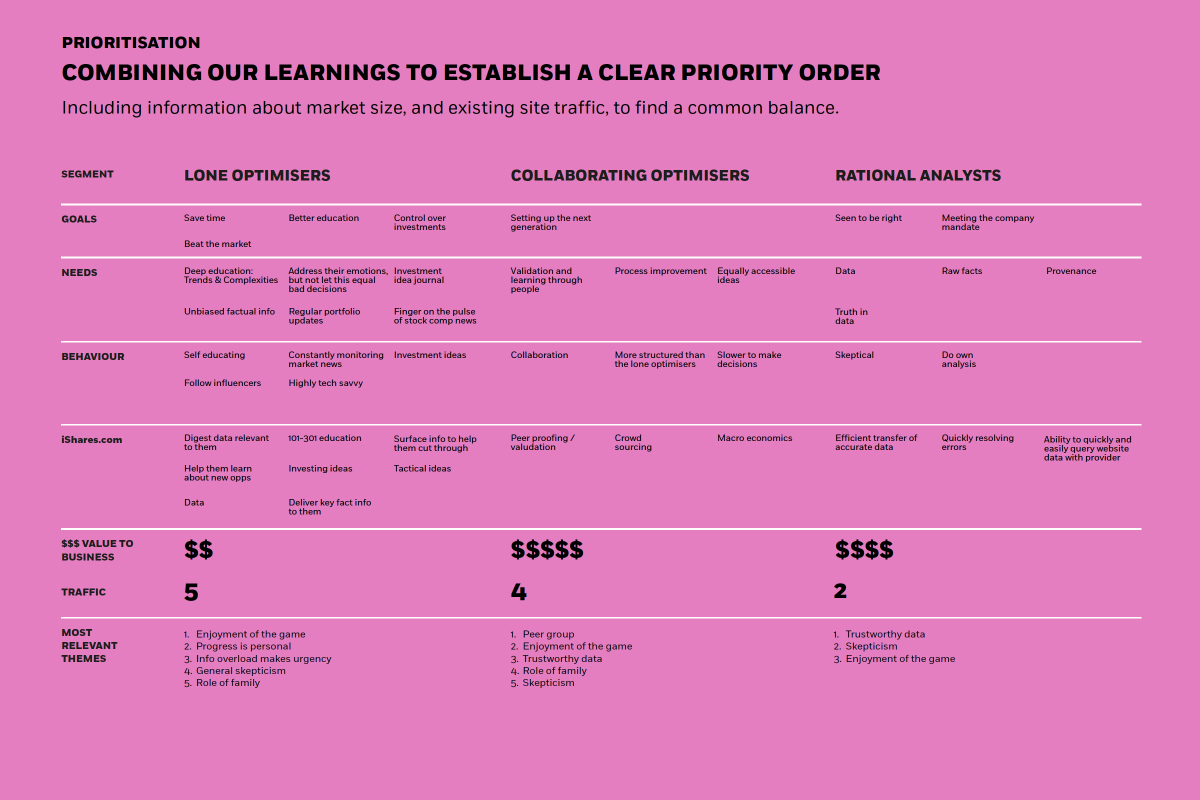

3. PRIORITISATION OF NEEDS

We examined what participants in these segments had told us about their online behaviour and research and purchase practices.

4. VALUE OF NEEDS

To map the values and needs of behavioural personas, we scored each segment according to the 7 key identified needs and then prioritised the segments into 3 groups.

The purpose and principles of the client:

A practically powerful digital service that matches every investor with the insight, information and tools they need to progress.

PRACTICALLY POWERFUL

“Client's capabilities come to life in an accessible and immediately useful way.”

MATCHING

“My research needs are recognised and served quickly and simply.”

TOOLS

“Client gives me the tools an information I need to continue my investment journey.”

PROGRESS

“The client's point of view is confident, world-leading and inspires me.”

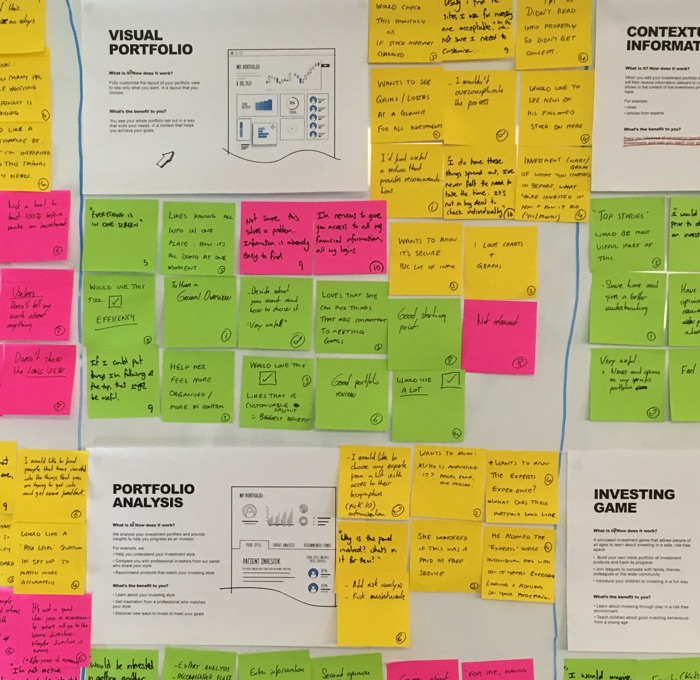

In the upcoming phase of work, we had the opportunity to gain richer insight using design provocations. After mapping and prioritising our segments and their needs, we considered which focus areas would benefit most from this activity.

In the upcoming phase of work, we had the opportunity to gain richer insight using design provocations. After mapping and prioritising our segments and their needs, we considered which of the focus areas would benefit most from this activity.

Deeper insight

Deeper insight

OUR BRAND MUST SHOW ITS STRENGTH BUT ALSO ITS COMPASSION

Size gives reassurance but offers little differentiation from other established names. Memorable brands understand people and consistently do the right thing.

HOW MIGHT WE…

Highlight consistency and quality when people are still learning about the brand.

TO BUILD TRUST, WE MUST ENABLE MORE HUMAN CONNECTIONS AND FUTURE ADVOCATES

TO BUILD TRUST, WE MUST ENABLE MORE HUMAN CONNECTIONS AND FUTURE ADVOCATES

People want to know they are making the right choices. They look to a trusted network to learn and contextualise their own position.

HOW MIGHT WE…

Help investors cut through the noise and understand what’s important.

GETTING DATA RIGHT MEANS EVERYTHING

Our scale and story allow us to become a trusted source of accurate and relevant data to help people make better choices.

HOW MIGHT WE…

Help investors understand whose advice is relevant and when.

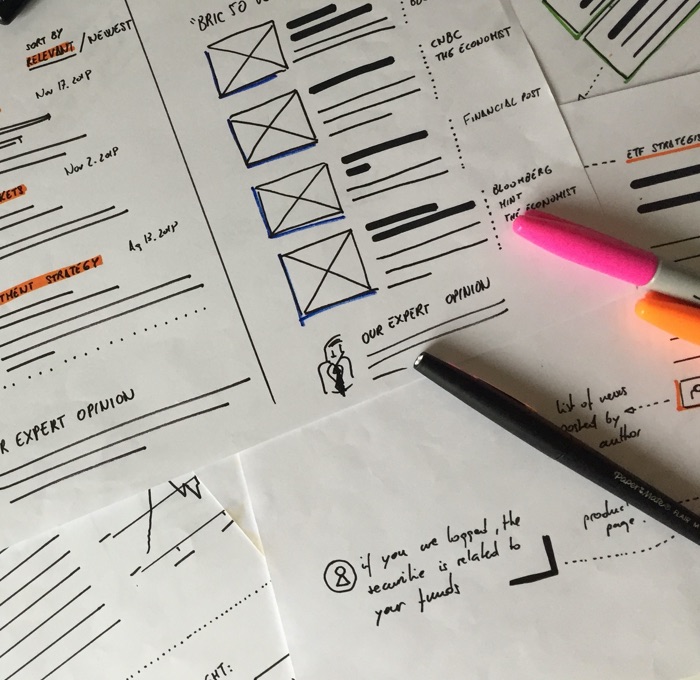

PROTOTYPING

To gain deeper insight, we ran a loop consisting of collecting examples about the themes we wanted to explore, voting for the best solutions, and elaborating hypotheses. We grouped the ideas into six broad areas for sketching sessions and testing using rapid prototypes that would help us evaluate those hypotheses.

CAPTURING

To obtain the best insights, it is necessary to map out every conversation and find patterns that help gather these inputs into broad groups.

WHAT USERS DO, NOT WHAT THEY SAY

Participants quite often say ideas rather than facts. Our mission consisted of joining the dots to discover motivations and actions to achieve the goals. Therefore, it is crucial to understand who the participants were, the segments they belong to, their age group or their expertise level.

WHAT WE LEARNED

After six months of testing and learning, we gained a thorough understanding of investors' motivations. Through these insights, we determined the best features for the client to connect with these investors and how to convert their needs into business opportunities.

Nanodoce

the alter ego behind Fernando Magan.

©nanodoce 2024

Please note that most projects are subject to a confidentiality agreement.